The Five‑Year Rule: A Fresh Perspective on Home Prices

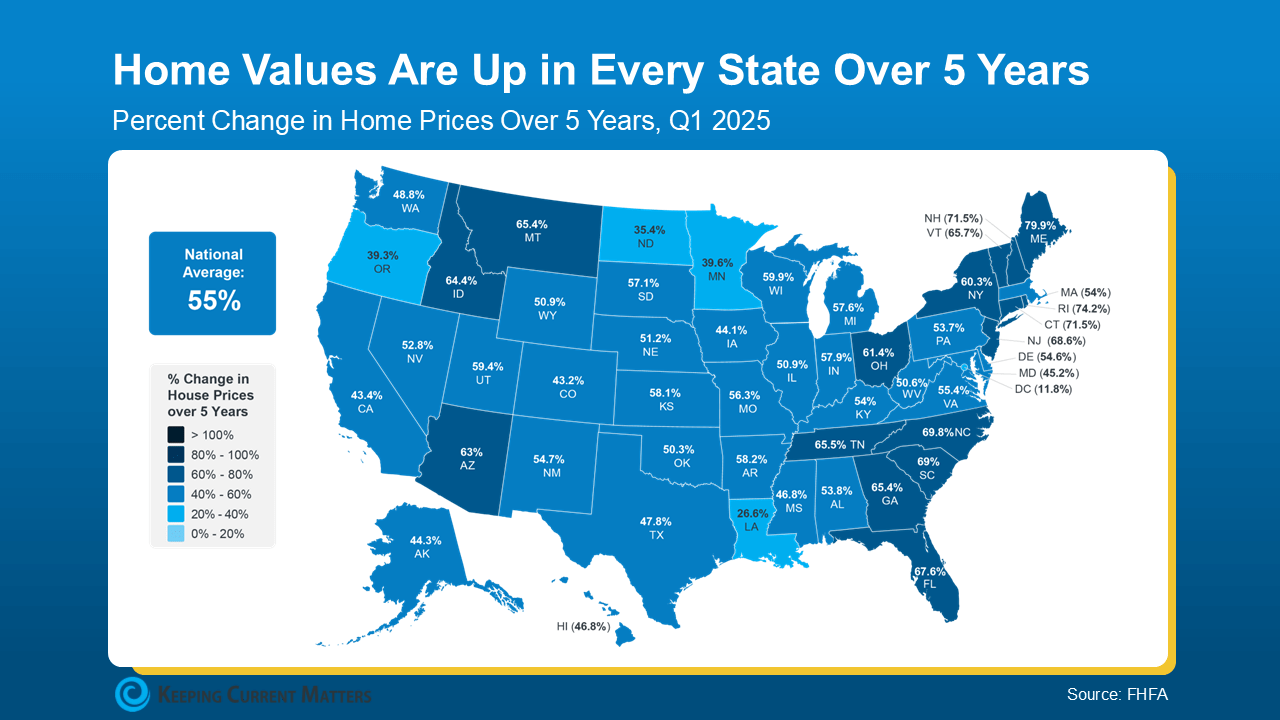

In recent weeks, headlines suggesting home prices have begun to dip in some markets can be concerning for homeowners and buyers alike. However, before making any rushed decisions, it's critical to take a step back and view the housing market through a broader lens.

What is the “Five‑Year Rule”?

This rule of thumb encourages homeowners and prospective buyers to measure home value performance over a five-year period—not month to month or year to year. In other words, don’t let short-term fluctuations cloud your long-term perspective. (SOURCE)

Why five years?

-

Smooths out volatility:

Real estate markets inevitably see seasonal shifts, interest-rate adjustments, and periodic economic shocks. Over five years, these ups and downs tend to average out. -

Reflects true appreciation:

Rather than reacting to headlines, evaluating a property’s appreciation over a half-decade provides a more realistic measure of equity gain. -

Supports smart strategy:

Sellers gain confidence that their home’s value has grown, while buyers better understand the medium-term opportunity—avoiding overpaying based on inflated short-term trends.

How it applies to New Jersey homeowners

In Northern New Jersey, where you serve clients, this long-term view can be especially reassuring. A home bought in 2020—so long as market conditions have remained reasonably stable—likely appreciated by 15–25% by now, even with some minor dips in between.

For sellers…

Frame your listing narrative around sustained appreciation over the past several years, highlighting metrics like cumulative ROI and equity growth. This positions your client’s home as a long-term investment, not just a short-term trade.

And for buyers…

A five-year outlook reinforces that buying today can still make financial sense—particularly if mortgage rates drop or local employment and amenities continue to improve.

Bottom line:

If you've owned your home—or plan to—for at least five years, short-term market blips are unlikely to jeopardize your investment. Maintain a measured, long-term stance and guide your clients accordingly.

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Read the original article from Keeping Current Matters here:

https://www.keepingcurrentmatters.com/2025/06/10/the-five-year-rule-for-home-price-perspective/?utm_source=Iterable&utm_medium=email&utm_campaign=hotsheet%2Bjun132025%2Bcandidate

Categories

Recent Posts

GET MORE INFORMATION